Artificial intelligence (AI) has gained significant attention as a potential solution to complex modeling problems, particularly in the field of investment banking. One area where AI has been extensively explored is the management of risks associated with derivative contracts. While there have been positive reports on the effectiveness of AI in this domain, concerns regarding its practical applicability have been raised. In a recent study published in The Journal of Finance and Data Science, a team of researchers from Switzerland and the U.S. investigated the use of reinforcement learning (RL) agents in hedging derivative contracts.

The researchers acknowledged that training an AI on simulated market data can yield good results in markets that mimic the simulation. However, the authors express concerns about the excessive data consumption of many AI systems. Furthermore, the lack of sufficient training data poses a significant challenge. To overcome this limitation, researchers often resort to assuming an accurate market simulator to train their AI agents. Unfortunately, this presents a financial engineering problem, requiring the selection of a simulation model and its calibration. This approach closely resembles the conventional Monte Carlo methods that have been used in the industry for decades. Consequently, the AI cannot be considered entirely model-free, as it heavily relies on market data availability, which is rarely the case in realistic derivative markets.

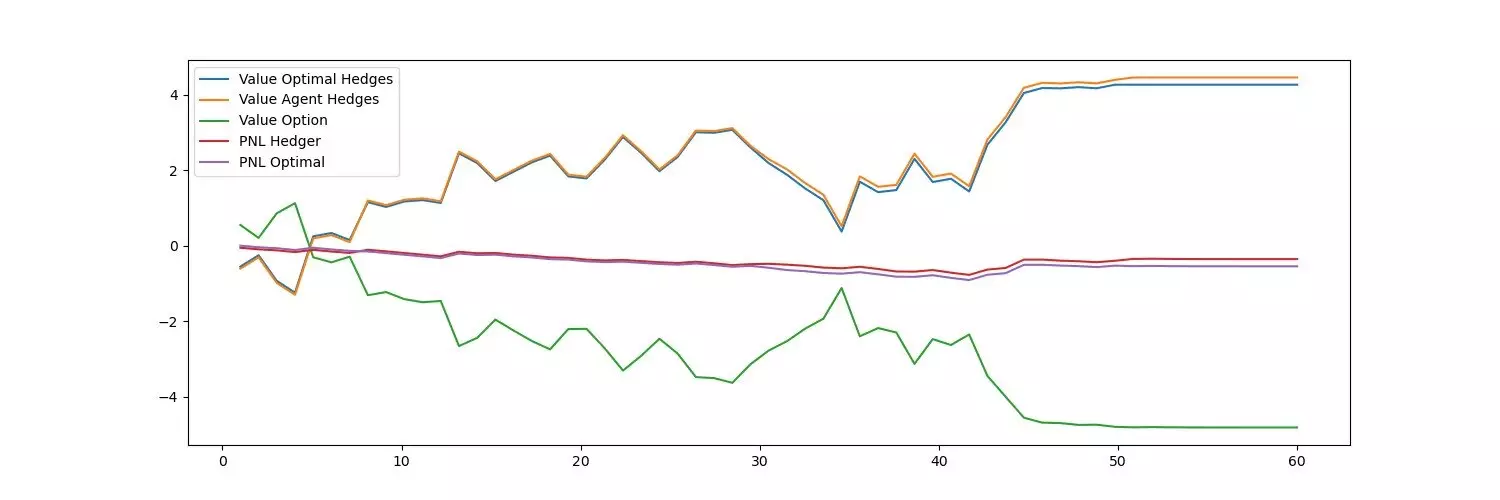

The study conducted by the team of researchers from IDSIA and UBS sought to address the limitations of previous approaches by utilizing a technique called Deep Contextual Bandits. This approach is renowned in RL for its data efficiency and robustness. The researchers designed their model with a focus on real-world operational requirements commonly experienced by investment firms. The model incorporates end-of-day reporting obligations and exhibits a significantly lower demand for training data compared to conventional models. Additionally, it is adaptable to changing market conditions, enhancing its practical relevance.

Senior author Oleg Szehr emphasizes that the availability of data and the operational realities faced by investment firms drive the actual implementation of risk management strategies, rather than ideal agent training. The newly developed model aligns with the business operations of investment firms, enhancing its practical applicability. Despite its simplicity, the model underwent rigorous performance assessment, which demonstrated its superiority over benchmark systems in terms of efficiency, adaptability, and accuracy under realistic conditions. The study suggests that a less complex approach can be more effective, highlighting the importance of simplicity in risk management.

The use of AI, specifically reinforcement learning agents, in the risk management of derivative contracts has shown promise. While concerns have been raised regarding the practical applicability of AI due to data availability and simulation limitations, the study conducted by researchers from IDSIA and UBS presents a viable solution. The integration of Deep Contextual Bandits, combined with a focus on operational realities, has resulted in a model that outperforms traditional approaches in terms of its efficiency, adaptability, and accuracy. The study emphasizes the significance of incorporating simplicity in risk management processes, proving that less can indeed be more effective. With further development and refinement, AI has the potential to revolutionize risk management in investment banking.

Leave a Reply